Pharmacy U presenters Mike Jaczko & Max Beairsto: The right way to think about your pharmacy’s lifecycle

If somebody were to ask, “What are the life stages of your pharmacy business?” many pharmacist-owners might find themselves struggling to find an answer. After all, running a pharmacy is hard, time-consuming work, and pharmacist-owners can get so focused on the day-to-day that they rarely step back to look at the big picture.

But they should. The way you as a pharmacist-owner think about the evolution of your business can make a big difference before, during and after it comes time to sell. Successfully selling a pharmacy – for an optimal price, in a way that leaves you financially and emotionally satisfied – is made a lot easier if you think about your pharmacy’s lifecycle the right way.

The first step in this mental exercise: stop thinking like a practitioner; start thinking like an entrepreneur. If you’re concentrating solely on doing a good job as a pharmacist, then you’re probably not looking far enough ahead. Smart entrepreneurs in any industry – technology, for instance – bake in the idea that one day they will sell their business, right from the beginning. You should too. Because the earlier you start focusing on the eventual exit from your business, the sooner you can plan, and you are increasing your chances of planning for it better, doing it better, and enjoying life more after you have sold.

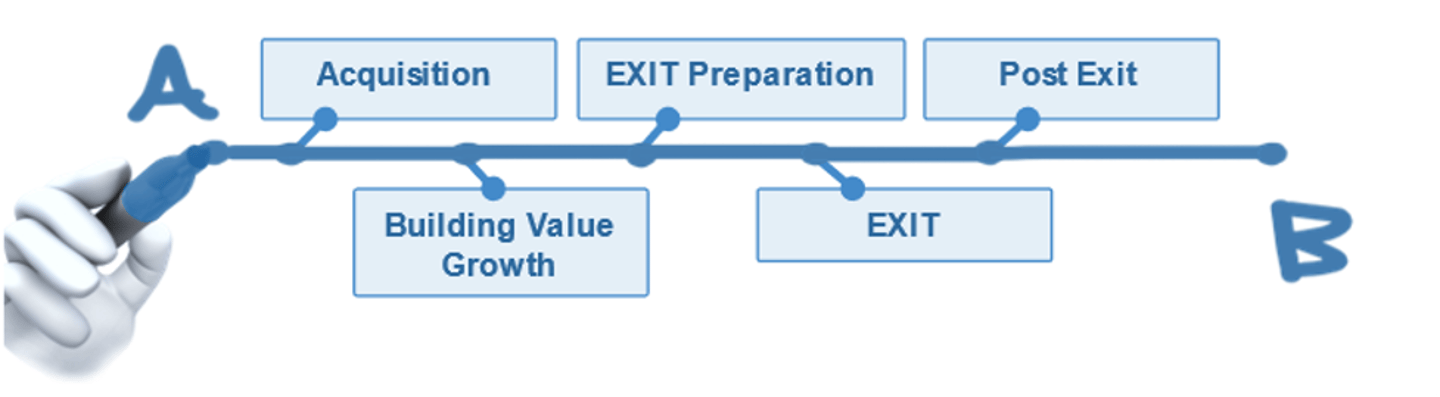

So, what is the right way to think about the lifecycle of a pharmacy? Here’s how we do it:

THE OWNERSHIP TIMELINE

We like to organize this value-based timeline for owning a pharmacy into these five distinct phases:

- Acquisition or startup

In this phase, an owner identifies an opportunity to purchase a retail pharmacy or start up their own business. - Value-building

Your focus in this phase is on growing and developing your pharmacy business to increase its value. Whatever you do to drive profitability, lower risk and increase cash flow will ultimately make the business more valuable. From customer service and inventory management to creating stronger relationships with suppliers, all these efforts will lead to better financial performance and a higher sale price when it comes time for an exit. Invest in your business today to pay dividends tomorrow. - Exit preparation

Unfortunately, this is one phase of the pharmacy lifecycle that pharmacist-owners often neglect, but it is super-important. Addressing the question of how to transition out of ownership and position your pharmacy for sale is what all the previous phases have led to. - Exit

This is the sale of your pharmacy, when you and the buyer(s) negotiate and execute a deal. - Post-exit

You might be on your way out the door, but the task of planning and preparing isn’t over. The sale of your pharmacy will probably be the biggest liquidity event in your lifetime, and it will raise new challenges – financial, emotional and lifestyle-related. The key question: Are you ready for the rest of your life?

This way of thinking about the lifecycle of your pharmacy can help you laser-focus on the twin tasks (and multiple challenges) of building value in the business and getting ready to sell it. To take all that on, you need to plan, both for your exit and for the long-term management of the wealth you will realize when you sell.

That’s why we always recommend that pharmacist-owners begin to plan for selling their business as early as possible. Exit planning – the process of developing a strategy to sell your ownership of a company – can help you establish goals, understand the steps you should take to maximize your pharmacy’s value, crystallize your timing and priorities, and set up guardrails that will prove invaluable during the sale process.

On a more personal level, the process of preparing for exit should include the development of a strategic wealth plan, which addresses your retirement goals, post-business lifestyle expectations, money management and a host of other factors that will prove important when you exit the business.

In later articles, we’ll take a closer look at exit planning, the ins-and-outs of the sale process and the importance of strategic wealth planning. For now, consider how and where your pharmacy is now on the lifecycle spectrum we’ve outlined above. And remember: As a pharmacist-owner, your “job” isn’t just to run a pharmacy, but also to build value – and to prepare for harvesting it.